Chainalysis and the Rise of the Crypto Surveillance State: Privacy at a Crossroads

A New Era of On-Chain Monitoring – at What Cost?

Blockchain analysis firm Chainalysis recently published its 2025 Crypto Crime Report highlighting how illicit on-chain activity is more varied and even tied to threats from national security to consumer scams. The report shows cryptocurrency being used in all forms of crime, including darknet markets and ransomware. In response, law enforcement and regulators have ramped up blockchain monitoring efforts, contracting companies like Chainalysis to trace funds across Bitcoin and other networks. Critics argue these measures are turning the transparent nature of blockchains into a mass surveillance tool, jeopardizing user privacy. While stopping criminals is important, privacy advocates worry that the cure is becoming worse than the disease – an ever-expanding on-chain surveillance state where everyone’s transactions are under scrutiny.

Chainalysis sits at the center of this debate. The New York-based firm has grown into a dominant player in what even mainstream observers call the “blockchain surveillance” industry . Public records show Chainalysis made over $10 million from U.S. government contracts in its first five years, and it now pulls in millions annually from agencies like the FBI, DEA, IRS, and even the Air Force . In fact, Chainalysis has been likened to the crypto-tracing equivalent of Palantir – a private intelligence contractor selling investigative power to the state. Government demand is surging despite crypto crime constituting a tiny fraction of blockchain activity. Chainalysis’s own data showed only 1.1% of Bitcoin transactions were illicit in 2019 . More recently, the firm estimated that in 2024 illicit addresses received just 0.14% of all cryptocurrency volume . Yet that tiny slice of bad actors has driven a disproportionate expansion of monitoring infrastructure that affects all users. the overwhelming majority of crypto activity is lawful, but everyone’s transactions are increasingly subject to analysis in the hunt for the few that aren’t.

Chainalysis’s federal contracts have ballooned over the years, as multiple U.S. agencies invest in blockchain tracing tools. By 2019, annual government spending on Chainalysis reached over $5 million (led by the IRS, ICE, FBI, and others), a 22,000%+ increase from just a few years prior . Critics say this reflects a rapidly growing surveillance apparatus for crypto transactions.

Blockchain Surveillance vs. Financial Privacy

Unlike cash, public blockchains broadcast every transaction to the world. Companies like Chainalysis specialize in clustering addresses and linking them to real-world identities or entities. By aggregating data from exchanges and other sources, these firms can often trace who is behind a given transaction. For investigators, this transparency is a feature – it turns Bitcoin’s ledger into a map of money flows that can be followed in perpetuity. Chainalysis boasts that its techniques make even “virtually indistinguishable” transactions traceable when combined with outside information . In practice, that means if law enforcement knows, for example, a suspect’s exchange account, Chainalysis tools can follow the funds on-chain even as they hop between wallets, mixers, or coins. No transaction is truly private when such tools are in play – every payment you make could be analyzed and flagged if it brushes against addresses deemed “risky.”

The ethical concern is that this creates a dragnet, sweeping up innocent users alongside criminals. Financial privacy – the idea that one should be able to spend or donate money without broadcasting it to the world – is at stake. Blockchain forensics firms are increasingly blurring the line between necessary oversight and surveillance overreach. Notably, Chainalysis has introduced a system called “Signals” that uses algorithms and heuristics to label certain unknown wallets as suspected illicit actors (with confidence levels from “likely” to “almost certain”) . These tags get added to the firm’s data even before any crime is definitively proven. To privacy advocates, this sounds like a high-tech form of profiling: addresses (and by extension, people) presumed guilty until proven innocent. The presumption of innocence risks getting lost when analytics platforms assign probabilistic “guilt scores” to blockchain addresses behind the scenes.

The effect is already felt by ordinary crypto users. Those who value anonymity – for perfectly legitimate reasons – find themselves under suspicion. For example, someone who uses a coin mixer or CoinJoin wallet to protect their privacy might later discover their funds labeled as tainted, or their exchange account closed, simply because an algorithm decided their coins have a criminal history. Even normal behavior can trigger false alarms. In the Bitcoin Fog case (discussed below), experts noted that something as mundane as splitting a dinner bill with a friend in Bitcoin could confuse Chainalysis’s clustering heuristics, falsely linking unrelated users as the same person . When automated blockchain monitoring is applied at scale, context gets lost – and innocent transactions can appear suspicious out of context. Privacy defenders argue that people shouldn’t have to choose between using cryptocurrency and enjoying basic financial privacy rights. They worry that blockchain surveillance’s endgame is a world where every crypto transaction is tracked, scored, and sanctioned, creating a chilling effect on the use of privacy tools.

Cracking Down on Privacy Tools: The Bitcoin Fog Case

One example of excessive blockchain surveillance is Bitcoin Fog and its alleged operator, Roman Sterlingov. Bitcoin Fog was a Bitcoin “mixer” – a service that let users commingle their coins with others to obscure their origin. For nearly a decade, it was one of the longest-running mixers, reportedly processing over 1.2 million BTC since 2011, including funds from darknet markets like Silk Road and AlphaBay . In 2021, Sterlingov, a 32-year-old Russian-Swedish national, was arrested in Los Angeles and accused of being the mastermind behind Bitcoin Fog . The case became a key test for blockchain forensics. Prosecutors, aided by Chainalysis’s tracing tools, claimed that Sterlingov was not just a user of the mixer but its operator – essentially accusing him of laundering $335 million worth of bitcoin on behalf of criminals over the years.

At first glance, nabbing the operator of a money laundering hub sounds like a win for law enforcement. But the evidence in this case was highly technical and, in the eyes of many observers, troublingly thin. There was no smoking gun – authorities never found the private keys or servers definitively tying Sterlingov to the Bitcoin Fog operation. Instead, the prosecution’s case “largely mirrored the original indictment,” which was based on tracing a convoluted series of transactions . The core narrative went like this: years ago, Sterlingov paid for the Bitcoinfog.com domain using Bitcoin that, when peeled through many hops, allegedly originated from one of Sterlingov’s own accounts. That circumstantial chain was the linchpin linking him to the mixer. Defense attorneys argued it was a house of cards – maybe Sterlingov’s money ended up paying for the site, but it could have easily been someone else along the line . After all, Bitcoin can change hands off-chain or through multiple wallets; a payment path doesn’t prove who ultimately initiated a transaction. Despite these arguments, after a tense trial in Washington D.C., the jury in March 2024 found Sterlingov guilty on all counts, including money laundering and operating an unlicensed money transmitter.

Privacy advocates and crypto legal experts decried the verdict as a prime example of blockchain surveillance overreach. “Bad blockchain forensics” convicted a man largely because he used a privacy tool, not because concrete evidence proved he operated it, one Cointelegraph op-ed argued . The Chainalysis analytics at the heart of the case have come under fire for their opacity and fallibility. Academic studies show that the heuristics Chainalysis and similar tools rely on can be wrong up to 90% of the time . For instance, Chainalysis uses a “co-spend” heuristic (if two outputs are spent together, assume they belong to the same user) and a “peel chain” heuristic (assume the largest output is change going back to the spender) – but both assumptions can easily break in real-world use . These algorithms might help generate leads, but on their own they are not proof of guilt. Even the DOJ’s own prosecutors have previously warned colleagues not to bring cases based on blockchain tracing alone, advising the need for corroborating evidence like control of private keys . In Sterlingov’s case, however, that caution was thrown to the wind – tracing analysis effectively became the evidence.

Perhaps most concerning was how the defense was hamstrung in challenging the forensic evidence. Chainalysis’s software, like many commercial blockchain analytics tools, is proprietary. When the defense pressed the Chainalysis expert witness on the reliability of her methods, she acknowledged critiques of the tracing heuristics but claimed a proprietary “secret sauce” in the software fixed those issues – without providing the actual code for independent verification . In a separate hearing, the Chainalysis investigations lead even testified she was “unaware” of any scientific studies proving the accuracy of the company’s flagship Reactor software . To put it bluntly, Sterlingov was essentially convicted by an algorithmic black box that the government asked the jury to trust. This scenario raises red flags for due process: how can a defendant fairly challenge evidence that amounts to “trust the software” – software that is developed by a private company with a vested interest in its courtroom success?

The outcome of the Bitcoin Fog case has sent a chill through the privacy community. It signals that using or operating privacy-enhancing technology can land someone in prison on par with major drug traffickers – even if direct evidence is scant. It also sends a message that blockchain surveillance works: after the verdict, Chainalysis trumpeted the conviction as validation that its analytics are “reliable and admissible in court,” calling the result a precedent that gives “prosecutors a valuable tool to prove guilt at trial” . In a company blog post, Chainalysis defended its methods as “transparent, tested, and reliable,” pushing back on the defense’s characterization of its software as a black box . However, many remain unconvinced. The fact is, no outside experts have fully audited Chainalysis’s algorithms, and the firm’s assurances that it only uses deterministic, empirically grounded clustering are difficult to verify from the outside. To skeptics, the Sterlingov case exemplifies how easily surveillance evidence can stretch beyond its limits, ensnaring a person largely because he sought privacy in his financial dealings. As J.W. Verret, a law professor who worked on Sterlingov’s defense, put it: Roman was perhaps the unluckiest early Bitcoin user – his profile (early adopter, tech-savvy, foreign) made him “an easy mark to pin the operation of [Bitcoin] Fog onto” , especially once analytics had painted a target on him.

The Broader Battle: Privacy Tech on Trial

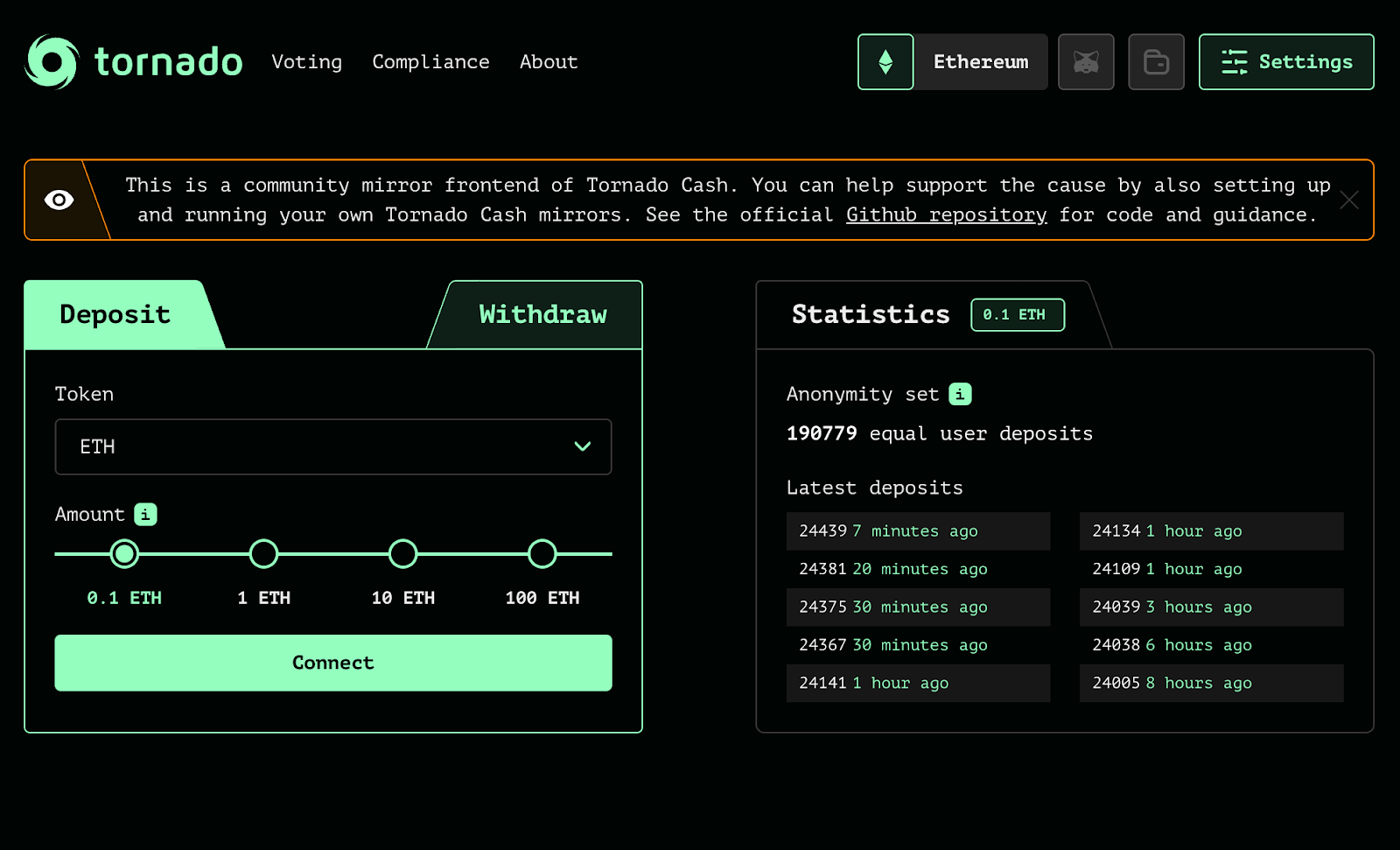

The implications extend beyond this case. The global crackdown on privacy tools is accelerating. In 2022, the U.S. Treasury sanctioned Tornado Cash, an Ethereum mixer smart contract, effectively banning Americans from using it. Within days, one of Tornado’s developers was arrested in Europe, GitHub took down the project’s code, and “a wave of fear and uncertainty swept the open source community about criminal liability for writing or developing code” for privacy services . However, in a surprising March 2025 reversal, the U.S. Treasury removed sanctions on Tornado Cash after a court ruled that immutable smart contracts do not qualify as sanctionable property. This decision offers a rare win for privacy advocates and signals a potential limit to state power over decentralized protocols. Despite the ruling, the legal battle is not over — Tornado Cash developer Roman Storm still faces charges in the U.S., and his trial is scheduled for July 2025. The outcome could have wide-ranging implications for developers of open-source privacy tools.

The sanctions rollback followed a November 2024 appellate court decision which ruled that the Treasury had exceeded its authority—since immutable smart contracts do not qualify as property under existing law. Although the sanctions were lifted in March 2025, experts warn that the removal was discretionary and does not create a binding legal precedent. As such, the Treasury could target similar technologies again in the future. Legal scholars and privacy advocates continue to call for stronger judicial oversight to prevent such overreach and to safeguard innovation in decentralized technologies.

To many, it was shocking: open-source software developers treated like criminals simply for creating a tool that preserves anonymity. Similarly, other mixing services have been shuttered or targeted; for example, the DOJ has taken down platforms like Helix and Blender in recent years for facilitating money laundering. And just this year, another U.S. court sentenced a different mixer operator to 20 years in prison, underscoring authorities’ aggressive stance that mixing equals money laundering.

Privacy advocates argue that this trend is effectively criminalizing privacy itself. Mixers, coinjoins, privacy wallets, and anonymity networks are dual-use technologies – yes, criminals can abuse them, but lawful users have plenty of legitimate reasons to want financial privacy (protecting their assets from hackers, avoiding corporate surveillance, or just personal discretion). By targeting the technology wholesale, governments risk painting all privacy-seekers as potential criminals. This runs contrary to the presumption of innocence and raises serious civil liberty questions. Imagine if using encrypted messaging or VPNs was seen as de facto evidence of wrongdoing – critics say blockchain privacy tools are on that same slippery slope. As the Electronic Frontier Foundation noted in the Tornado Cash case, sweeping actions against privacy code cast a long shadow on free expression and innovation in security tech . When developers fear jail for building privacy features, progress in privacy tech is chilled for everyone – and that ultimately harms law-abiding users who just don’t want their entire financial history exposed on a public ledger.

Defending Financial Privacy in an Age of Analytics

The rise of blockchain analytics has undoubtedly helped catch criminals, from ransomware rings to darknet kingpins. But as the old saying goes, power corrupts, and absolute power corrupts absolutely. The power to trace and deanonymize cryptocurrency at scale is profound, and its unchecked use inches us toward a financial panopticon. The challenge society now faces is finding the balance between security and privacy in the crypto realm. On one hand, we have firms like Chainalysis enabling an unprecedented degree of financial surveillance, eagerly adopted by governments hungry to “make sense of the tangled web” of crypto crime . On the other hand, we have the principles of privacy and due process being tested in new ways, as seen in the Sterlingov case and the assault on mixer technologies.

Stepping back, one thing is clear: financial privacy is not a crime. Owning a privacy tool or using one to keep your lawful transactions confidential should never be seen as inherently suspicious. There is a growing call, especially among the crypto community and civil liberties groups, to defend the right to privacy in digital payments. This could mean pushing for higher standards of evidence in prosecutions that rely on blockchain analysis – ensuring no one is convicted on blockchain heuristics alone. It could mean demanding transparency and audits of blockchain forensics software, so that defendants can challenge (or verify) the claims these tools make about them. And it likely means educating policymakers that not all “crypto anonymity” is nefarious, and that blanket surveillance can have unintended consequences on innovation and freedom.

In the rush to curb illicit finance, we must be careful not to trample on core liberties. The blockchain was born from a cypherpunk ideal of empowering individuals – a world where you don’t need permission to spend your money, and you aren’t automatically watched as you do so. Those values are now at odds with the trajectory of heavy-handed monitoring. As blockchain surveillance expands, it’s vital to ask: Who watches the watchers? Companies like Chainalysis have amassed incredible insight into global crypto flows, effectively becoming extensions of law enforcement. Yet they operate with little public oversight, and their errors can have life-altering consequences. Without safeguards, today’s push to catch criminals could morph into tomorrow’s financial Big Brother.

The story of Roman Sterlingov and Bitcoin Fog is a cautionary tale. It shows how a zeal for catching “the bad guys” can risk ensnaring the wrong person, and how easily the tools of surveillance can leap beyond their intended scope. It challenges us to uphold principles of justice – like due process and innocence until proven guilty – even amid novel technological terrain. Ultimately, the fight is not about one mixer or one analytics firm; it’s about the future of privacy in the cryptocurrency age. As we forge that future, we must ensure that the blockchain doesn’t become a blank check for mass surveillance, and that the right to financial privacy is preserved as carefully as the drive to root out crime. The balance we strike now will define whether cryptocurrencies fulfill their promise of freedom, or whether they become just another domain of constant monitoring. The choice between a free, privacy-respecting financial system and a surveillance-heavy one is being made today – and it’s up to us to insist that privacy remains a core value, not a casualty, of the crypto revolution.